And this provides a rule to calculate cap rates for other deals, right? The stabilized asset brought a lower cap rate (higher price) than the unstabilized asset. The regional operator may struggle to operate Pebblebrook, but they can add revenue with some heavy lifting. Now the private equity firm should enjoy a predictable $1 million annual (minus mortgage payments) cash flow stream from Tanglewood with little concern. An aggressive regional operator with a turnaround plan bought this deal for $20 million. The private equity firm passed on this deal since they were seeking stability, predictable income, and a lack of hassles. They have more units than Tanglewood, so their annual NOI is also $1 million. Their vacancy is high, their rents are low, and they’re having difficulty keeping staff. This is a 4% cap rate ($1mm ÷ $25mm = 0.04).ĭown the street, Pebblebrook Apartments are a mess. A private equity fund acquires this property for $25,000,000. They don’t want the hassle and uncertainty of making upgrades, evicting tenants, and replacing management. Institutional investors want low risk and stable returns. Rents are at market levels, occupancy is near 100%, marketing is optimized, and management is a well-oiled machine. Tanglewood Apartments is fully stabilized and running like a top. So when comparing different assets, one would think the cap rate for a stabilized property is lower than a value-add property.

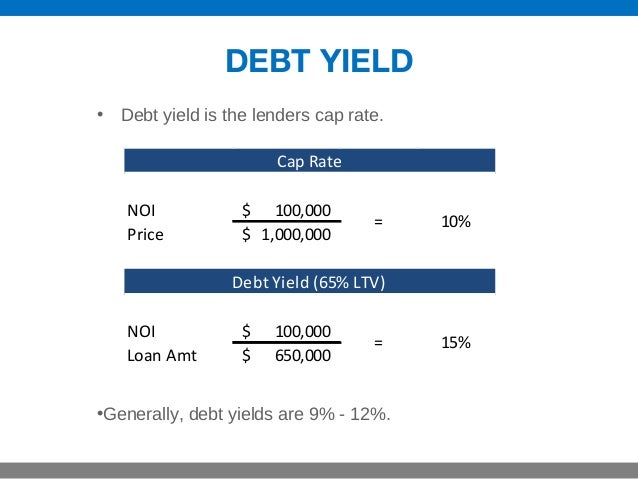

You can learn more about the cap rate in this post.Ī lower cap rate for the same asset means a higher property price. You can estimate this as the unleveraged return for a property like this in a location like this at this time and in this condition.

STABILIZED YIELD ON COST NOI CALCULATION HOW TO

Some ask how to calculate the cap rate for a property they want to invest in. It is the price per dollar of net operating income (NOI). It is like the price per pound when buying meat. The cap rate is generally outside the commercial syndicator’s control. It’s generally calculated as the unleveraged rate of return on an income-producing property. The cap rate is a measure of market sentiment. This confused me in my earlier years as a real estate investor. Acting on Brian’s advice can help you make a profit and build wealth in any market climate. It delves into the thesis for buying and optimizing properties with hidden intrinsic value.Īs I’ve discussed in many posts, this thesis is critical in times like these, where the real estate market has soared to new heights, and some investors are overpaying. This speaks to the whole strategy of buying value-add vs. Please note that this issue goes much deeper than just solving a riddle. With the help of my friend and fellow BP author, Brian Burke, I’ll try to solve this mystery in this post. I think a lot of investors are confused about why cap rates on some value-add deals are lower than cap rates for similar stabilized deals. Like the ongoing mystery of semi-boneless ham: does it have a bone…or not? Have you ever been confused about something that should be perfectly clear?

0 kommentar(er)

0 kommentar(er)